Businesses Will Do Anything For This

The Most Desired Service in 2024 & Beyond!

Air.ai Used this technology to Generate $11 Million In Revenue From Just $250k Ad Spend in 30 DaysHere's

E-commerce Brand ‘StickerYou’ Brought In An Additional $200k Using this technology

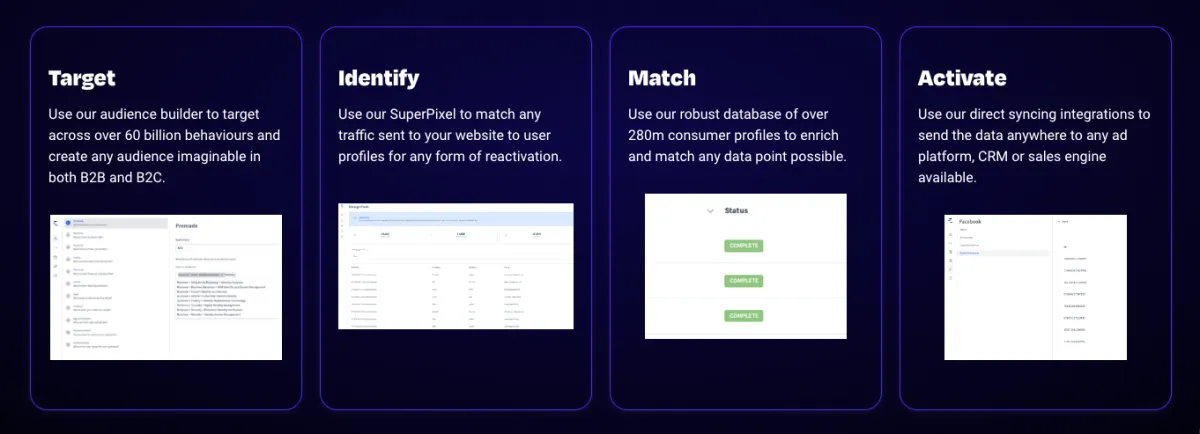

Find Customers With Intent to Buy Specific Products and Services

Find Qualified Leads With Budget